Why we need a personal loan for remittance in UAE? This is the most frequent question asked by our readers. The answer is very simple that either you are stuck into a loan or now you have to pay the installments so you will approach a bank. The second reason might be a plan for your own residence in UAE which is only possible with the investment package by a lender in the form of home loan.

First of all, there is a need to understand the formula of personal loan. We can call it a mortgage loan in which you can get a loan on behalf of some property to manage your problems. The two parties – a borrower who is taking a loan and a lender the provider of the loan will do a written agreement. The two basic points in this agreement are about the loan amount and time period for which it is valid. Second, the property assurance to return after the complete loan is paid back.

|

How we can get a loan for remittance?

Dubai has become the focal point of tourist attraction and trade services all over the world. The two things are working in parallel, means the entertainment factor and the trade services. You have seen tallest buildings and man-made beaches and islands, this is all about Dubai. To access all those services, you have to own a lot of reserves because this is too much expensive. The local authorities are trying to facilitate by making everything possible for customers, be it commercial or personal through a personal loan for remittance by taking the services of banks working in UAE.

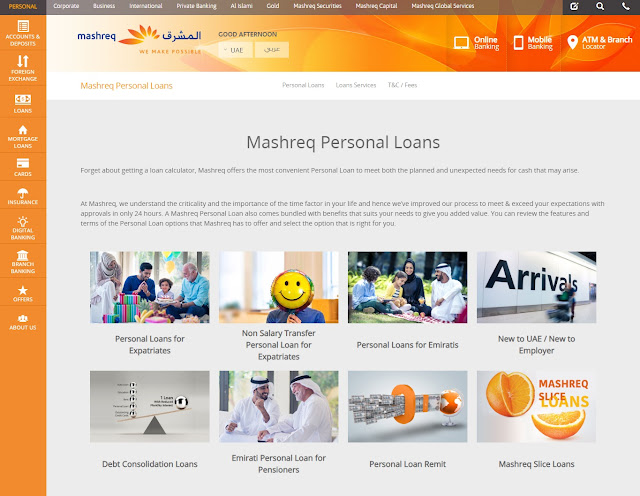

So for the best policy that is being offered by banks in Dubai is for sure a loan service. Following are the main types of loan in Dubai:

- Mortgage loan

- Domestic loan

- Commercial loan

- Loan for remittance

With lenient eligibility criteria set by banks in Dubai, one can take the services of all types of loans. But the most important type is a loan for remittance and its criteria are a bit tough than other.

The basic criteria require an individual to earn at least the minimum of the salary with at least AED 5000 and a permanent work permit in UAE. Secondly, the borrower previous credit history is a major thing which defines the approval of a loan.

Well, Mashreq Bank in Dubai with the lowest interest rate can provide the best option for a maximum personal loan for remittance in UAE.

No comments:

Post a Comment