This is a forex market trading which is completely unpredictable and within nights one can be a hero and the other day one be a zero. So be careful while playing in this market. The volatility and uncertainty in the market have changed the trading business into another phase in which profits can be earned even in the small amount of investment. But at the same time, there is another face of this market which is a bit tricky. There is a risk that someone can get into a loss if he/she has invested a huge amount. To save yourself from a loss as everyone is looking for a profit, this article is very important to read out.

Well, we will try to cover both sides of the picture so that an investor will get maximum benefits from our guidance. We will cover the following aspects of online forex trading:

- What are the basics of forex trading in Dubai?

- What is the possible way to plan for forex trading?

- What is the difference between online forex trading and traditional way of trading?

So moving towards our first question, forex trading is the currency market in which a trader or an investor should have enough information about the currency rates which are pretty stable in the international market. For example, if we talk about the currencies then at the top of the list we see Dollar, Euro, and AED.

If one considers this market in a smart way, for sure this is a big platform for initial investors and traders to earn money in an easy way. Due to its easygoing moves, almost everyone wants to quickly learn the ways to buy forex online services, which is most commonly known as the foreign exchange market. This is tricky to handle all the services as there is need to keep one thing in your mind that if you can earn money from one source, the other day you can lose your savings as well due to a misunderstanding. Now this problem can be solved if we look into our second question.

What are the possible ways to handle forex trading?

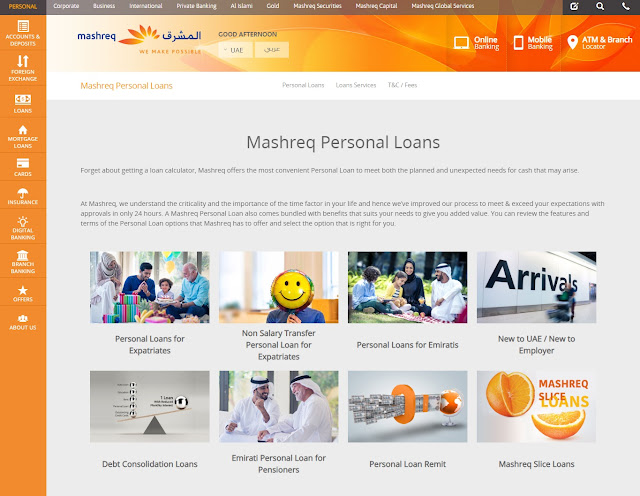

The best and easy way to handle online forex trading, we suggest you approach a bank in Dubai which is providing such type of services. You need to open an account and get the digital services. Now just download the official app of a bank and log in your forex account by your smartphone and you will be in the competition.

The other thing which is about the factor of diversification is also pretty much important to be noted. When you are going to purchase some currencies, try to cover maximum currencies in which you can deal. But make sure that all these services are being catered by your online forex broker because he/she is the right person for all these tasks.